Film Reviews

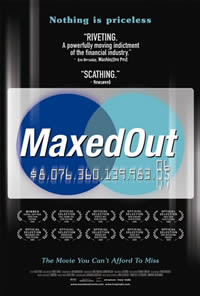

Maxed Out (2006)

Maxed Out (2006)

Here is a good film about a bad problem. It ought to be compulsory viewing before your kid leaves for college and signs a few credit card applications in the quad in exchange for a frisbee—and a future of credit card hell. One mother explained in tears that her kid had no job and 12 cards, each one maxed out with $1,000 of debt. Her friend recalls how she and her husband both worked thirty years ago but were denied cards. Adjustable rate mortgages, minimum monthly payments, zero down loans, no payments for a year, and interest free transfers help explain why the average American has $9,205 of credit card debt and will fork over $1300 a year on interest alone. The national debt is about $9 trillion and increasing by more than a billion dollars per day. Your family's share is about $100,000. To make its own minimum monthly payments the government has raided Social Security reserves, until those too vanished in 2005. Maxed Out interviews all the actors in this fiscal nightmare: Congressional inquiries, gurus like Suze Orman and Dave Ramsey, common debtors, ruthless collectors, pawn shop brokers, and corporate executives who keep a straight face when they explain why the incredibly profitable and easy money they offer us is such a good thing.